|

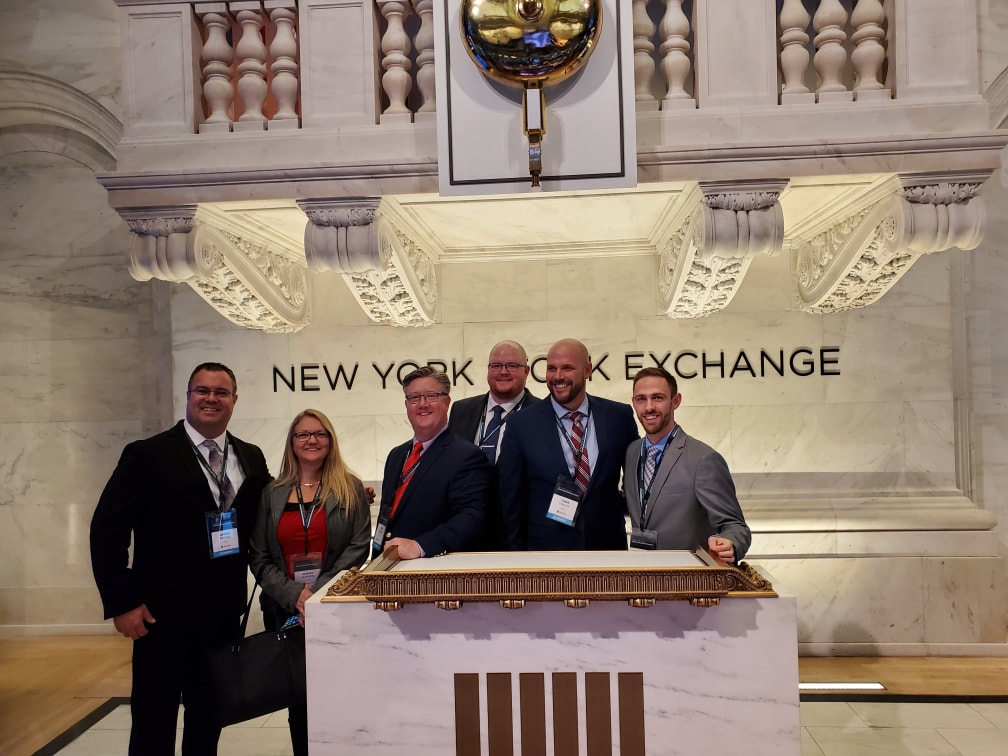

12/10/2019 ANNEXUS NYCPictured: Jason Waters, Ashley Hopkins, Rob Williams, Matt Ruddick, Chris Yokley, Nick Yokley FOR IMMEDIATE RELEASE Chris Yokley, and Nick Yokley Join an Elite Group of Financial Professionals at Annexus NYC. Exclusive Advisor Training Focused on New Retirement Solutions By: Emma Bradford Social Media Manager

1 Guarantees and protections are based on the claims-paying ability of the issuing carrier. About Annexus

Annexus designs solutions to help Americans grow and protect their retirement savings. ANX21379 – Annexus Dec NYC Advisor Press Release For over a decade, Annexus has developed market-leading retirement-focused-insurance products. Find out more about Annexus and its products at www.annexus.com. 10/29/2019 The Brokerage WorldPictured: (Left to Right) Kurt Cheesbro, Dave Wagner, Emma Bradford, Samantha Katchen, Maggie Garcia, Matt Ruddick Within the industry there are many different avenues to venture down while looking for a career path. At Advocate Financial Partners we focus on personal lines of insurance including life, health, disability, and long-term care. All of the agents that are associated with Advocate are contracted with all of the top rated insurance companies that offer these products. This allows our agents to have a wide variety of products, companies, and underwriting guidelines to work with. Not all insurance agents work in this type of environment, many are what is classified as "captive" rather than "broker". Partner, Samantha Katchen shares her ventures in the insurance industry filled with trials, tribulations, and success. By: Emma Bradford Social Media Manager In The Beginning

After a Little While

Now I Realize

It Takes Awhile

"Loving what you do, who you work with, and being in the right environment makes all the difference."9/18/2019 Life Insurance AwarenessPictured: Kurt Cheesbro, Emma Bradford, Chris Yokley, Matt Ruddick, Mike Rice, Dave Wagner Life insurance awareness is something we at Advocate feel very passionate about. Throughout this blog we want to highlight some key aspects of what our agents see on a daily basis; from the perspective of one of our Partners, Mike Rice. By: Emma Bradford Social Media Manager Now is the time

Peace of mind

Health matters

Getting your life insurance through work

Financial Protection

What does life insurance mean to you?7/31/2019 Level UP!Click the linked photo to watch! CEO & Founder Chris Yokley started his career working for a captive agency. Captive agencies are insurance companies that only sell one companies products. He realized how much this limited how he could help his clients, so he made the move to the independent world. Independent agents can work for many different insurance companies, but keeping records, payment schedules, tracking leads, managing contracts, and all of the back office support is left up to the agent to do themselves. Doing all of these tasks on your own on top of seeing clients, booking appointments, plus writing and tracking business can be a lot to manage. Partnering with a marketing organization in the business that helps with all of the back office and administrative tasks is key for success. By: Emma Bradford Social Media Manager Chris Founded Advocate out of the frustration between the captive insurance industry and the independent insurance industry. Both sides have positives and struggles. Only being able to offer your clients two or three different products was not really allowing him to provide a solution to a clients need. While having all of the companies in the state to choose from but no training, or support presented difficult as well. Advocate combines the best of both worlds by offering agents a home where they can partner alongside other like minded individuals who strive to make a difference in their clients life, their communities, and the insurance industry as a whole. It supports a culture of collaboration and teamwork focused on serving and protecting families. We aim to build authentic relationships through our passion to see others fulfill their purpose while acting with courage to do what is right in all situations. “The creation of Advocate Financial Partners came from the passion to serve alongside others on their financial journey, clients and agents alike.” ~ CEO/Founder Chris Yokley Five years ago Chris made the decision to partner with American Senior Benefits on his quest to educate and empower the senior community. American Senior Benefits provides agents not only with the company support that they need but the very best product portfolio, and gives managers the ability to focus on building a team. Advocate Financial Partners would not be what it is today without the power of an amazing Field Marketing Organization like American Senior Benefits. The need to provide customers with a “one size fits all” solution is eliminated. ASB helps satellite offices like Advocate Financial Partners obtain a model that creates a culture of teamwork, innovation, and a shared drive for success all centered around the client’s needs and satisfaction. With more than 1,400 affiliated agents operating out of 100+ nationwide locations, ASB has created an infrastructure and support to meet the needs of both the agent and the client. Although American Senior Benefits has grown to be one of the major market leaders in providing Medicare, Life Insurance, Annuities, Long Term Care, and other specialized health care insurance products; it was time to take things to the next level and position itself by creating a partnership that would be beneficial to all parties. “Integrity understands that agents are the engine of success for our entire organization and this industry. With Integrity in our corner, we will continue to run American Senior Benefits as before, but the sky’s the limit on what we can achieve together.” ~Co-Founder of American Senior Benefits Clay LeGeyt Founded in 2006, Integrity Marketing Group is the nation’s leading independent distributor of life and health insurance products focused on serving the Senior Market. The number one Field Marketing Organization in the insurance world, focuses on supporting its partners with Finance, Technology, Human Resources, Legal, Compliance and Corporate Marketing. They allow insurance carriers, agents, and agencies to utilize Integrity to gain a clear path towards diversifying their product mix and deepening distribution. With proven distribution relationships, they now serve as the marketing resource for many large insurance companies. They help streamline the sales process to increase profitability across the value chain. With 50 states reached, over 200,000 agents served, and 800,000 new clients per year, American Senior Benefits and Advocate Financial Partners alike are pleased to join forces to make an impact and serve the senior market to the best of our abilities! “Joining forces with American Senior Benefits is transformational for Integrity and will catapult us to even higher levels of success by combining two of the largest organizations in the Senior Market” ~ Co-Founder & CEO of Integrity Bryan W. Adams Sources:

Integritymarketing.com Americanseniorbenefits.com Advocatefinancialpartners.com

Pictured: Dave Wagner (left), Emma Bradford (right) From the desk of our founder: This month I thought it would be a great opportunity to feature somebody so important to the AFP family. A year ago I had the opportunity to meet someone that instantly sparked my passion to reach the younger generation coming out of college. So many times young college kids come out of school looking for a job that tells them what they are worth. I believe we are all called to serve a purpose in life, each persons calling is unique. Not all college graduates need to end up in a corporate environment in order to fulfill that calling. Emma Bradford from the moment I met her was somebody that said she was going to take on the world and make her own path. It’s been very inspiring to watch her go from admin to marketing director to now handling all of our social media as well as running her own day-to-day schedule taking on new clients. I have loved watching her succeed. We are so thankful for her hard work and behind-the-scenes efforts with our website, social media, and representing Advocate at numerous networking events that she attends. Thanks for all you do Emma and keep telling your story! By: Emma Bradford Social Media Manager April 2018

Pictured: Mike Morrell, Shawn Cook, Chris Yokley, Chris McMath, Nick Yokley Often times, financial professionals have a business structure that is geared towards helping clients create a portfolio with one "simple solve". While providing advice and information on only one product can make the process easier on both parties, it can also lead to major gaps. We are in the business of providing a holistic approach to your financial plan by exploring all options available in the insurance and financial market. That way, no matter where life may take you, there will always be multiple layers of protection. "Everyone needs someone to be an Advocate for them, and that is what we aim to be" Shawn Cook, the Wealth Adviser at Advocate Financial Partners, shares his experiences and expertise in the financial industry & the insurance industry. His background as an educator has played a vital role in developing his approach and how he serves clients each and every day.

"Wealth is nothing without the health to enjoy it"

"Secure your health with the right plan"

"The key is to Plan, Protect, and Preserve"

"Start planning earlier, you will have less stress later on!"

2/28/2019 Motivation from Matt

1/31/2019 Catching Up With Chris

We would like to open the doors of Advocate Financial Partners and help you understand who we really are and why we do what we do. In an effort to do this, our first blog post will dive into the mind of our founder and CEO Chris Yokley. We will explore the experiences that he has had in his life and what lead him to create Advocate Financial Partners, his hopes for the future, and some insights into….. By Emma Bradford Feb. 1, 2019 Why did you create Advocate Financial Partners?“Five years ago, I found myself trusting everyone that was surrounding me in the world of insurance. I quickly realized that all they cared about in this cut throat and deceitful environment was the money. Sleepless and stomach aching, I realized that I was being called for something bigger.” |

Proudly powered by Weebly

RSS Feed

RSS Feed